Taxes for Teens and Young Adults. By: DeAnn M. Cox, MileStone Academy, Director of Marketing and Outreach

Introduction – Taxes for Teens and Young Adults

Did your teen or young adult child enter the workforce and receive a paycheck?

Taxes can be confusing, especially if you are a teen filing for the first time.

Now is a great time to start talking about taxes. Teaching your children about taxes helps remove the fear and stress of tax filing.

By giving them the essential info, they need, you empower them to be the master of their money. You can share simple but critical tax filing knowledge with your teen.

Do not worry. I compiled a beginner’s tax guide with everything you need to know.

Do teens have to file taxes?

Let us start with the answer to the most critical question. The answer is simple: It depends on how much they earn.

When you are under 65 and single, the IRS expects you to file if you earn more than the standard deduction amount that year.

Whether or not a teen or young adult must file a tax return, a first job, and investments can be a great start to their financial education.

Whether or not a teen or young adult must file a tax return, a first job, and investments can be a great start to their financial education.

When do teens have to file a return?

By law, we must file federal tax returns when we make at least $12,550 — the standard deduction for the 2021 tax year.

Earn less than that, as teenagers do; you do not have to file a federal tax return.

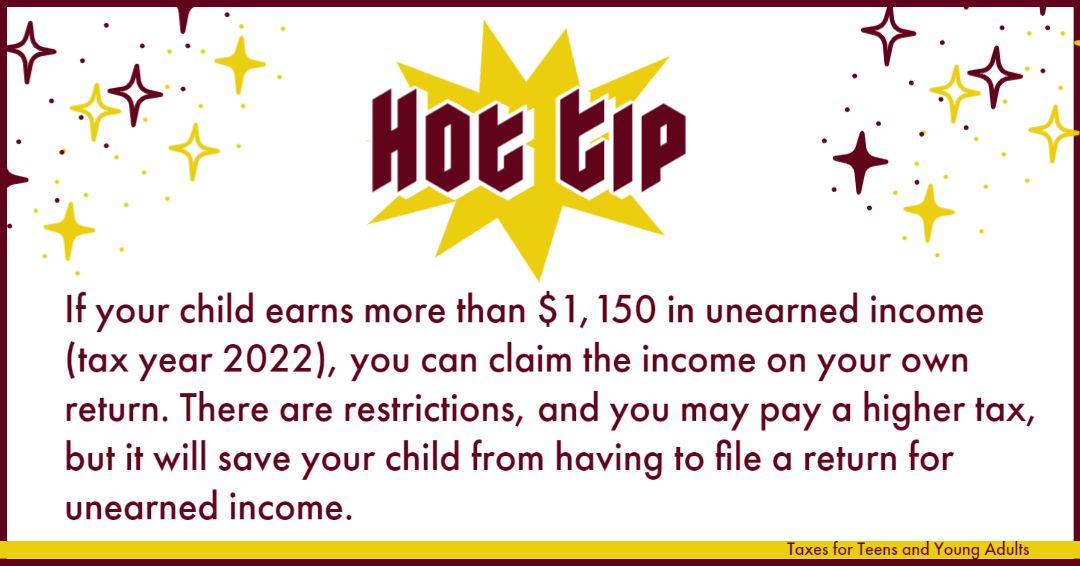

The exception, says Yves-Marc Courtines, a financial planner in Manhattan Beach, CA, is for the so-called kiddie tax.

A dependent child with over $1,100 in unearned income (typically from interest or investments) must file a return.

Any unearned income above $2,200 is taxed at the parent’s rate.

This means that the teen who earned a wage by working as an ice cream scooper or summer camp counselor and made less than $12,550 during 2021 is not legally required to file a federal tax return.

On the other hand, a kid who has done well in cryptocurrency or stock trading may need to file.

Key takeaways

-

A minor who may be claimed as a dependent must file a return if their income exceeds their standard deduction ($12,950 for the tax year 2022).

-

A minor who earns less than $12,950 will not owe taxes but may choose to file a return to receive a refund of withheld earnings.

-

A child who earns $1,150 or more (the tax year 2022) in “unearned income,” such as dividends or interest, must file a tax return.

-

A little earning tip or making more than $400 (the tax year 2022) in self-employment must pay Social Security or Medicare taxes, regardless of their total earnings.

Wrapping it up

Watch this space for more financial literacy topics, such as:

-

Tax Filing Requirements for Children

-

What forms should teens and young adults use to file their taxes?

-

Earned and unearned incomes

-

How are guardians affected by teens and young adults?

-

What teen taxes affect guardians?

-

Understanding your filing status

-

How can a tax return help families afford college or trade school?

-

Are teens taxed for side jobs?

-

Tools and resources the IRS offers to help teens and young adults.

-

And more!

Here are more MileStone Academy blogs we think you would enjoy:

Works Cited: Taxes for Teens: A Beginner’s Guide. Taxslayer Editorial Team. Posted on February 7, 2023. Retrieved on April 7, 2023; Does Your Teen Need to File a Tax Return? Carrie Schwab-Pomerantz. Charles Schwab. Posted on March 16, 2022. Retrieved on April 7, 2023; At What Income Does a Minor Have to File an Income Tax Return? TurboTax Expert. Intuit TurboTax. Posted December 1, 2022. Retrieved on April 7, 2023; Why Should Teenagers File a Tax Return — Even if the IRS does not require it? Ingrid Case. Money.com. Published February 7, 2022. Retrieved on April 7, 2023.